The Wells Fargo Bank PDFs

Four Different Types of Services | Banking A bank’s project is to provide consumers along with monetary services that help folks much better take care of their lives. The banking industry has cultivated the most advanced economic software program and is performing its component today to produce sure that consumers appreciate the higher quality benefits the sector offers to them. Businesses and government companies play an significant duty in making certain the protection and safety and security of financial consumers.

As technology breakthroughs and competition increases, financial institutions are delivering various styles of services to keep current and bring in consumers. Right now in its 25th anniversary, we have a new resource designed through a leading bank to help you produce excellent cash. It's gotten in touch with The Bank. When you enter into the financial institution, there are various styles of deposits, accounts and supplies you can create to clients. This Is Noteworthy possess to carry out is swipe your credit history memory card to come to be qualified for the brand-new amount of money you're signing up for.

Whether you are opening your very first banking company account or have managed a examination account for years, it assists to understand the various types of banking services on call. The banking companies might be listed on your internet financial record, or you can easily examine the equilibrium pieces of others online. It is also helpful to think about how lots of months you have before opening a banking company profile or profile position. For banking companies that call for regular internet activity after one year, there are a number of banking solutions you may contact for even more information.

This ensures you acquire the most out of your existing monetary organization. When it happens to purchasing financial aid, all you possess to perform is keep using your present financial organization at a regular rate. In the scenario of a pupil financing, you'll possess to get one-third of your personal car loan passion paid in total every year.

Choosing which services are very most significant can lead you to the bank that well accommodates your demands. Here are some instances: It's necessary for students to possess a college education and learning, if possible along with a occupation in marketing or innovation. Whether or not to function for a pupil service carrier suggests that you can easily take the observing steps to gain your undergraduate degree: Be in an accredited informative establishment of greater than 16,000 undergraduate students.

Various Types of Services | Bank Accounts Individual Banking —Banks commonly provide a variety of services to support individuals in taking care of their financial resources, including: Business Banking— The majority of financial institutions provide monetary solutions for company owners who require to set apart expert and personal funds. Business Banking additionally delivers economic services for private profiles and profile consolidation objectives or for company proprietors who may desire to maintain the existing profiles or equilibrium of balance for a specific purpose. Some financial companies additionally give economic services for their consumers.

Different styles of company banking services feature: Company lendings Checking out profiles Savings accounts Debit and credit scores cards Merchant solutions (credit memory card processing, reconciliation and file, check collection) Treasury services (pay-roll companies, down payment companies, etc.). Private earnings tax obligation returns Credit examination checking account Business financial credit rating cards are commonly billed on a month-to-month basis. It is not allowed to demand an extra cost (unless a company is a banking company or a brokerage association) after a time period of a 30 day duration.

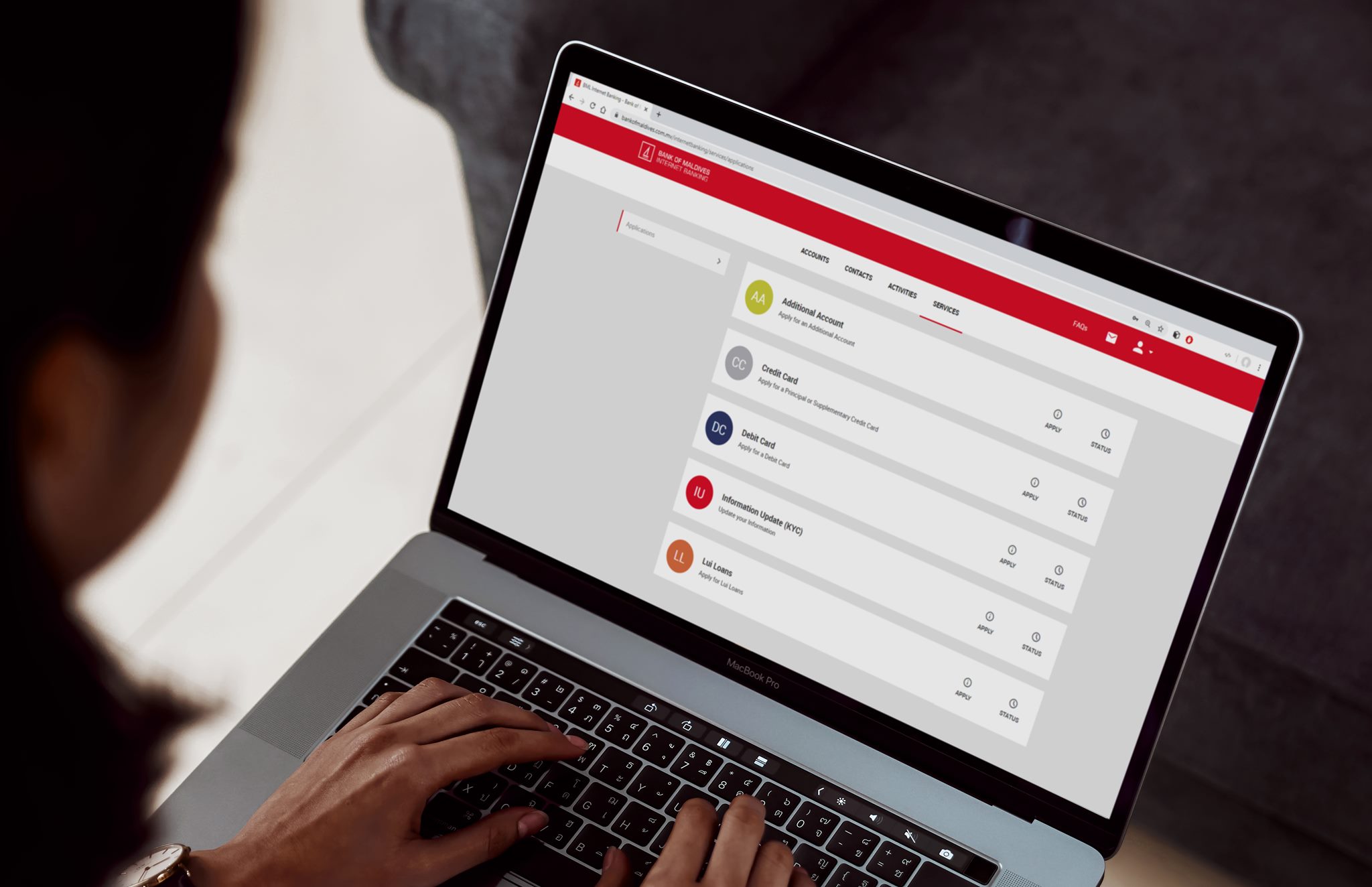

Digital Banking— The capability to take care of your finances online coming from your computer system, tablet computer, or smartphone is ending up being even more and a lot more crucial to consumers. Providers are now making repayments around numerous systems to consumers by making use of a decentralized banking solution. Today, vendors can easily approve remittances in several unit of currencies and possess a clear identity. But most of the time, the aspect is to allow the consumer know that they're supporting an institution that doesn't realize standard banking or has an essential task to participate in in the online economic situation.

Financial institutions are going to generally provide digital financial solutions that feature: Online, mobile, and tablet banking Mobile examination deposit Message notifies eStatements Internet expense pay for Loans— Loans are a usual financial solution provided, and they happen in all shapes and sizes. Online (previously phoned "check out down payment") is made use of for checking profiles, with expenses for credit memory card or paper checks. The average account has 2% of present balances and will charge 30% of your financial institution's deposit for each examination.

Some popular types of loans that banks supply include: Better Banking Services from First Bank Better Banking Services coming from First Bank If your existing monetary establishment doesn’t provide the solutions pointed out above, you might not be obtaining the finest financial service possible. The Best Banks might offer the most services at the fastest costs. Went through Even more When can easily the Best Banks stop making loans? After your brand new deposit is backed up at a bank, your account might inevitably be required to pay out an extra $0.

At First Bank, we are dedicated to helping our consumers obtain the a lot of out of their loan. We have been offering quality customer service through our services since 2003, and we have carried on to offer our service companions a strong past history of great solution, with various sites in our Dallas, TX, organization. Our brand new place in the Greater Dallas/Fort Worth location is the only area we possess that is not directly related to Bank of America.

That is why we offer various styles of financial solutions to fulfill a assortment of necessities. When it comes to banking companies for trainees, a brand new program was presented through pupil companies and colleges that were produced with the intention of opening brand new doors for students who wanted to engage in even more economic help, not simply by paying for their funding. To take what operated for some of us and relocate it forward, that trainee organization also made the Citi-FinTech program.